Dear Metra Customer Service:

I attempted to board outbound train #2101 at the Grayland stop with a bicycle this morning at 6:50 AM. According to your schedule, this train permits up to 15 bikes per train. I and another cycling commuter were turned away by conductors with whistles, shouts, and hand-waving. He and I both asked why, and were both told "no bikes!" as the doors closed. Now destined to be late for work, my best course of action was to return home and drive, which I did.

At just after 8:00 AM I called your rider services line to complain about being denied service, and was treated very rudely by Gloria. She raised her voice and interrupted me multiple times on the phone call, despite my attempts to simply lodge my complaint and move on. It was during this unpleasant conversation that I learned that the reason I was denied service by Metra was because the Taste of Chicago was going on at the Lakefront, and Metra will allow no bikes in either direction on any train during that festival. I was also told that I should have known this because "it's on the website." By the end of the call, I suspected that my concerns were being ignored, so I asked Gloria to read back my complaint, which she refused to do. I asked to talk to her supervisor; Hersey (best guess on his name) got on the line and implied that I was the one being unreasonable, but did eventually have Gloria read me back my complaint. Whether it went anywhere from there, I have no idea.

I pointed out to Hersey that I could find no mention on the Metra website that I could not bring a bicycle on an outbound train at 6:50 AM because of a festival downtown (behind the train) that starts at 11:00 AM (4 hours after I would have disembarked). After 2:00 PM, I received a voicemail message giving me instructions on how to find the information - apparently it took Metra employees six hours to find the information on your own website!

And where can it be found? On the front page, which shows important service announcements that might affect your customers' commutes as well as "News" about Powerpoint presentations from your CEO and updates about how you are trying to designate some cars as "quiet"? No. On the schedule of my train line, the page most likely to be bookmarked by your customers, and the page that states that 15 bicycles are allowed per train? No. On the Service Updates page, which duplicates the service announcements on the front page? No. In fact, there are no links on the front page that take me directly to a page stating this policy. The only page that I could find that stated that bikes were forbidden today was your Metra Bicycle Policy 2011 page. The most direct route from your front page to this page is:

1) Click on Service Updates on the top menu bar of the front page.

2) Click on Bikes On Trains on the left menu of the Service Updates page.

Your level of customer service when I called was not great, but Hersey did a competent job resolving the situation; that is not the reason for this letter. However, I have two issues with your Bikes on Trains policy:

1) The policy is illogical and arbitrary, making it impossible to use common sense to follow, and making it necessary for me, your customer, to memorize this policy so that I can jump through the scheduling, logistical, and procedural hoops.

2) The policy is very poorly communicated, being tucked away on your website in a place where common sense would not dictate I look while planning my commute. One would think that if there was an exceptional situation that might result in your customers being stranded at the station, it would be good business to highlight that information to prevent letters like this one from being sent.

In the end, one thing is clear: I cannot rely on Metra for transportation. If I am to commute from my home in Chicago to my work in Glenview, I must rely on my own transportation or experience an unacceptably high risk of not getting to work. Metra clearly does not want bicyclists as customers, despite paying lip-service through your confusing and discouraging policy. As one of the millions of Chicago citizens that supports Metra through my sales taxes, this saddens me.

Sincerely,

Mark McCracken

P.S. This open letter, delivered to you as an email, has also been posted to my public blog at http://riskofruin.markmccracken.net.

Disclaimer: I am not an investment advisor. When I describe my own trading activities, it is not intended as advice or solicitation of any kind.

29 June 2011

13 June 2011

Weights on my Fingers

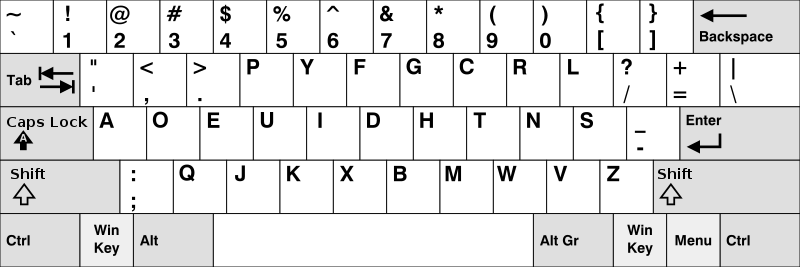

I'm converting over to a Dvorak keyboard layout from the standard QWERTY layout that most of the English speaking world uses. It is an extremely gradual and frustrating process. I've been touch-typing on QWERTY since high school in 1985, and I have clocked myself at over 110 wpm on that layout. I am, at this moment, after a week of immersion and many typing tutor games, belting this blog post out at a blazing 30 wpm. I feel like an Olympic sprinter with two broken ankles.

I tried this once before about a year ago, but gave up after a few days out of frustration. So of course I had to start over and try again!

I locked myself out of my workstation twice in one day this week. On the second lock-out, the IT guy insisted I explain my sudden inability to enter my own password. When I told him I was trying to convert to Dvorak, he suggested, "if you want to make life difficult on yourself for no reason, just put weights on your fingers." Then he asked the obvious and common question: Why?

There are four reasons, which I will give in increasing order by how much they influenced my decision. Coincidentally, these are also in increasing order by how much scorn they are given by my wife when I answered the same question from her.

First, and least persuasive (and drawing no scorn all from the wife), Dvorak is a more natural layout, resulting in lower risk of repetitive stress injury. For past RSI victims, it is also less likely to cause a flare-up because it's easier on the tendons.

Slightly more persuasive, and inducing only the momentary hesitation in my wife that means she considers it frivolous but realizes that it might be a factor for her under similar circumstances: Dvorak is considered by many to be significantly faster than QWERTY, owing to the careful research done to map the keys to fingers based on usage frequency. If I can scream along on QWERTY at 110 wpm, how fast can I go on Dvorak??? Today's answer: 30 wpm. Ugh.

Third, causing a smirk and an aren't-you-silly headshake, I'm doing it because it's difficult.

But the real reason, causing my wife's eyes to roll like marbles, is that it's a very nerdy thing to do, and I think it would be cool. In this context, "cool" is defined as making the nerdiest person you know envious. Normal people would not consider that the appropriate definition of "cool", but that's not my problem.

I do seem to be making some progress: yesterday after limping along for nearly a week on nothing but Dvorak, I went back to typing on QWERTY for a couple of typing tests, just so I could feel fast again. Kind of like that last pack of cigarettes stashed under the bed for a "rainy day" (or so I've heard). Much to my horror, my first QWERTY test result was also only 30 wpm! I actually had to look at the keyboard to find the "N" key a couple of times. I repeated the test a few times, and finally plateaued at 70 wpm - still a far cry from my customary speed.

So, that means I can no longer type in any layout. That's progress, right?

By the way, that scornful IT guy admitted later in the conversation that he had always kind of wanted to try to convert himself. See? Geek cred.

I tried this once before about a year ago, but gave up after a few days out of frustration. So of course I had to start over and try again!

I locked myself out of my workstation twice in one day this week. On the second lock-out, the IT guy insisted I explain my sudden inability to enter my own password. When I told him I was trying to convert to Dvorak, he suggested, "if you want to make life difficult on yourself for no reason, just put weights on your fingers." Then he asked the obvious and common question: Why?

There are four reasons, which I will give in increasing order by how much they influenced my decision. Coincidentally, these are also in increasing order by how much scorn they are given by my wife when I answered the same question from her.

First, and least persuasive (and drawing no scorn all from the wife), Dvorak is a more natural layout, resulting in lower risk of repetitive stress injury. For past RSI victims, it is also less likely to cause a flare-up because it's easier on the tendons.

Slightly more persuasive, and inducing only the momentary hesitation in my wife that means she considers it frivolous but realizes that it might be a factor for her under similar circumstances: Dvorak is considered by many to be significantly faster than QWERTY, owing to the careful research done to map the keys to fingers based on usage frequency. If I can scream along on QWERTY at 110 wpm, how fast can I go on Dvorak??? Today's answer: 30 wpm. Ugh.

Third, causing a smirk and an aren't-you-silly headshake, I'm doing it because it's difficult.

But the real reason, causing my wife's eyes to roll like marbles, is that it's a very nerdy thing to do, and I think it would be cool. In this context, "cool" is defined as making the nerdiest person you know envious. Normal people would not consider that the appropriate definition of "cool", but that's not my problem.

I do seem to be making some progress: yesterday after limping along for nearly a week on nothing but Dvorak, I went back to typing on QWERTY for a couple of typing tests, just so I could feel fast again. Kind of like that last pack of cigarettes stashed under the bed for a "rainy day" (or so I've heard). Much to my horror, my first QWERTY test result was also only 30 wpm! I actually had to look at the keyboard to find the "N" key a couple of times. I repeated the test a few times, and finally plateaued at 70 wpm - still a far cry from my customary speed.

So, that means I can no longer type in any layout. That's progress, right?

By the way, that scornful IT guy admitted later in the conversation that he had always kind of wanted to try to convert himself. See? Geek cred.

12 June 2011

The Dangers of Stubbornness

A facebook friend enjoyed the comment I made in my previous post: "Or else it's the beginning of a downtrend, and your position is doomed - you can never tell which." Reading her comment on facebook, I started to reply in place and realized I had a lot more to say than a couple of lines. So I'll put it here.

As I said earlier, the Collaboration is Good trade is a mean-reversion trade. This is actually a misnomer, as there is no "mean" the market is returning to; a more accurate term would be "trend-reversion", but the industry uses the terms it uses. In any case, the general principle is that when a market is in a long-term trend, and has a short period (the length of this period varies by market) of returns counter to that trend, a correction back toward the long-term trend is more likely than a continuation of the short term counter trend. I realize for most readers, that makes very little sense, so let me illustrate.

Example: A Rubber Band

Go get a rubber band - say a medium-sized one about 4 inches long, and hold it in your left hand at a stationary height. With your right hand, grasp its other end and stretch it a few inches downward and release it. It snaps back, but not too violently, right? Now stretch it a lot farther than you did before - to something like 12-14 inches. Notice how you feel the band begin to fight you, equaling out the force of your hand with its own elastic properties? OK, release it, and notice how much faster it returns to slack. In fact, it probably bounced up past the fingers of your left hand - in finance, we call this over-correction. It may have snapped your fingers, too, which provides a good object lesson on why you shouldn't take my blog commentary as advice.

The problem with the rubber band example is that the market is not being held stationary in someone's left hand. Because of the vast chaos and complexity that exists in the capital markets, there is plenty of room for contrary viewpoints. One of these is the Random Walk Hypothesis. In a nutshell, it states that the market cannot be predicted, and any apparent successes in doing so are simply luck.

Counter Example: The Coin-Flip Fallacy

Imagine we have a fair coin for flipping, one that gives heads 50% of the time, and tails 50% of the time. Now, if we flip this coin 3 times and then report its results in percentage terms without giving the flip count, it will look terribly weighted toward one or the other (67%/33%, or even 100%/0%). As we flip it more and more, though, we naturally expect it to approach 50/50. Does that mean that a long run of all heads makes tails somehow more likely? Of course not - any reasonably aware person can see that the results of any given flip of the coin are independent of all previous flips.

But when roulette players mutter about a particular number being "due", isn't that the exact same thing? As the number of variables increase, the complexity goes up; this, in turn, makes the game look more and more beatable. Now how much more complex is the capital market system than a game of roulette? If it is indeed just a random environment, no human has the ability to intuitively detect that - we're just not wired that way.

I was once forced to "prove" to a previous employer that die rolls in a craps game were independent of each other. I put it in quotes because the only thing that constituted proof, to him, was a complete model of the entire game that he could run various betting systems on until he managed to convince himself it was just a negative expected-value game of chance. This man was a trader - none of us are immune.

I personally prefer to believe that the market is not random - instead, it is the numerical result of millions of complex and confusing variables and herd psychology. Whenever I evaluate a strategy, I try to understand the underlying causes for the apparent pattern. If I can't identify any, I find it very difficult to trust the predictive nature of the strategy.

Real-World Data Sample

Starting in March, 2009, the S&P (proxied here by SPY) enjoyed a massive 14-month, 85% rally. One leg of that rally started in July and ended in October. Backtesting reveals that CiG would have signaled a buy on September 28, after 3 days of counter-trend price movement. That time period is visible here, with a couple of trendlines to help remove some of the noise (click the picture for a larger view). For the curious, yes there were other signals - profitable ones - near Aug 17 and Sep 2. But they had more bowl-shaped corrective rallies, and thus were not as clear an example as Sep 28, took its profits after a single day.

Starting in March, 2009, the S&P (proxied here by SPY) enjoyed a massive 14-month, 85% rally. One leg of that rally started in July and ended in October. Backtesting reveals that CiG would have signaled a buy on September 28, after 3 days of counter-trend price movement. That time period is visible here, with a couple of trendlines to help remove some of the noise (click the picture for a larger view). For the curious, yes there were other signals - profitable ones - near Aug 17 and Sep 2. But they had more bowl-shaped corrective rallies, and thus were not as clear an example as Sep 28, took its profits after a single day.

Here is a zoomed-in view of SPY at the time of the trade signal. I've overlayed a Relative Strength Indicator to help illustrate the stretching rubber band effect that CiG is designed to capture.

As you can see, SPY built up three days of upward corrective pressure, shown by the red counter-trend line. Finally, nearly all that pressure was relieved on Sep 28 with a 19-point (in the futures) rally. CiG would have signaled a buy on the close of Sep 25 (Friday), and a flattening sell on the close on the next trading day, Sep 28, booking a $950/contract profit.

Double-Down or Go Home

Essentially, the reasoning behind doubling one's investment in a trade that has lost money goes like this:

Even if it makes sense for the trade at hand, it ultimately is a Martingale. If a trader decides to take this approach, even after some soul-searching and healthy self-doubt, he ought to first clearly define his risk-management rules. The truly dangerous nature of a Martingale, to the plan-deprived, is that at any given moment during this trade, booking the loss looks worse than taking on a little more risk. Notice that the reasoning above doesn't ask two important questions: can I bet a greater slice of my financial life that my model is flawless and applies to this situation? and do I have more capital to allocate?

CiG doesn't attempt to answer these questions - good strategies shouldn't presume to be that comprehensive. Instead, it does not allow increasing position size within a security, and limits the list of securities traded; it also has predefined stop-loss limits. When the limit is crossed, the position is closed and the loss is booked. Period.

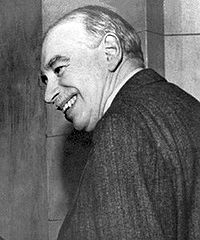

Even if a trade is good, even if the market is irrational and you have positioned yourself to take advantage of it when it returns to normalcy, you may not have the required funds to reap those benefits. As John Maynard Keynes famously said: markets can remain irrational a lot longer than you and I can remain solvent.

And that, my friends, is the Risk of Ruin.

As I said earlier, the Collaboration is Good trade is a mean-reversion trade. This is actually a misnomer, as there is no "mean" the market is returning to; a more accurate term would be "trend-reversion", but the industry uses the terms it uses. In any case, the general principle is that when a market is in a long-term trend, and has a short period (the length of this period varies by market) of returns counter to that trend, a correction back toward the long-term trend is more likely than a continuation of the short term counter trend. I realize for most readers, that makes very little sense, so let me illustrate.

Example: A Rubber Band

Go get a rubber band - say a medium-sized one about 4 inches long, and hold it in your left hand at a stationary height. With your right hand, grasp its other end and stretch it a few inches downward and release it. It snaps back, but not too violently, right? Now stretch it a lot farther than you did before - to something like 12-14 inches. Notice how you feel the band begin to fight you, equaling out the force of your hand with its own elastic properties? OK, release it, and notice how much faster it returns to slack. In fact, it probably bounced up past the fingers of your left hand - in finance, we call this over-correction. It may have snapped your fingers, too, which provides a good object lesson on why you shouldn't take my blog commentary as advice.

The problem with the rubber band example is that the market is not being held stationary in someone's left hand. Because of the vast chaos and complexity that exists in the capital markets, there is plenty of room for contrary viewpoints. One of these is the Random Walk Hypothesis. In a nutshell, it states that the market cannot be predicted, and any apparent successes in doing so are simply luck.

Counter Example: The Coin-Flip Fallacy

Imagine we have a fair coin for flipping, one that gives heads 50% of the time, and tails 50% of the time. Now, if we flip this coin 3 times and then report its results in percentage terms without giving the flip count, it will look terribly weighted toward one or the other (67%/33%, or even 100%/0%). As we flip it more and more, though, we naturally expect it to approach 50/50. Does that mean that a long run of all heads makes tails somehow more likely? Of course not - any reasonably aware person can see that the results of any given flip of the coin are independent of all previous flips.

But when roulette players mutter about a particular number being "due", isn't that the exact same thing? As the number of variables increase, the complexity goes up; this, in turn, makes the game look more and more beatable. Now how much more complex is the capital market system than a game of roulette? If it is indeed just a random environment, no human has the ability to intuitively detect that - we're just not wired that way.

I was once forced to "prove" to a previous employer that die rolls in a craps game were independent of each other. I put it in quotes because the only thing that constituted proof, to him, was a complete model of the entire game that he could run various betting systems on until he managed to convince himself it was just a negative expected-value game of chance. This man was a trader - none of us are immune.

I personally prefer to believe that the market is not random - instead, it is the numerical result of millions of complex and confusing variables and herd psychology. Whenever I evaluate a strategy, I try to understand the underlying causes for the apparent pattern. If I can't identify any, I find it very difficult to trust the predictive nature of the strategy.

Real-World Data Sample

Starting in March, 2009, the S&P (proxied here by SPY) enjoyed a massive 14-month, 85% rally. One leg of that rally started in July and ended in October. Backtesting reveals that CiG would have signaled a buy on September 28, after 3 days of counter-trend price movement. That time period is visible here, with a couple of trendlines to help remove some of the noise (click the picture for a larger view). For the curious, yes there were other signals - profitable ones - near Aug 17 and Sep 2. But they had more bowl-shaped corrective rallies, and thus were not as clear an example as Sep 28, took its profits after a single day.

Starting in March, 2009, the S&P (proxied here by SPY) enjoyed a massive 14-month, 85% rally. One leg of that rally started in July and ended in October. Backtesting reveals that CiG would have signaled a buy on September 28, after 3 days of counter-trend price movement. That time period is visible here, with a couple of trendlines to help remove some of the noise (click the picture for a larger view). For the curious, yes there were other signals - profitable ones - near Aug 17 and Sep 2. But they had more bowl-shaped corrective rallies, and thus were not as clear an example as Sep 28, took its profits after a single day.Here is a zoomed-in view of SPY at the time of the trade signal. I've overlayed a Relative Strength Indicator to help illustrate the stretching rubber band effect that CiG is designed to capture.

As you can see, SPY built up three days of upward corrective pressure, shown by the red counter-trend line. Finally, nearly all that pressure was relieved on Sep 28 with a 19-point (in the futures) rally. CiG would have signaled a buy on the close of Sep 25 (Friday), and a flattening sell on the close on the next trading day, Sep 28, booking a $950/contract profit.

Double-Down or Go Home

Essentially, the reasoning behind doubling one's investment in a trade that has lost money goes like this:

- I still think the trade will work out and be profitable; in fact, I feel that it is more likely to have a winning result now that the security I'm trading is even more incorrectly priced.

- Given that the probability of success is higher now than when I originally entered the trade, I should allocate more capital to it.

Even if it makes sense for the trade at hand, it ultimately is a Martingale. If a trader decides to take this approach, even after some soul-searching and healthy self-doubt, he ought to first clearly define his risk-management rules. The truly dangerous nature of a Martingale, to the plan-deprived, is that at any given moment during this trade, booking the loss looks worse than taking on a little more risk. Notice that the reasoning above doesn't ask two important questions: can I bet a greater slice of my financial life that my model is flawless and applies to this situation? and do I have more capital to allocate?

CiG doesn't attempt to answer these questions - good strategies shouldn't presume to be that comprehensive. Instead, it does not allow increasing position size within a security, and limits the list of securities traded; it also has predefined stop-loss limits. When the limit is crossed, the position is closed and the loss is booked. Period.

Even if a trade is good, even if the market is irrational and you have positioned yourself to take advantage of it when it returns to normalcy, you may not have the required funds to reap those benefits. As John Maynard Keynes famously said: markets can remain irrational a lot longer than you and I can remain solvent.

And that, my friends, is the Risk of Ruin.

11 June 2011

Victory From the Jaws of Defeat

It's been another exciting week in the markets. Last Friday, the CiG trade sent up a buy signal on S&P Futures. At the close, I dutifully bought at 1297. Monday morning, all looked well as the market opened nearly unchanged and immediately rallied a couple points; that would prove to be the best price this position would ever see. It fell the rest of the day, closing at 1285.25, a loss of $587.50/contract. Tuesday looked great for a while, accelerating upward overnight to 1292 and reaching a high of 1295.5 - only a $75/contract loss - before giving it all back again in the last 2 hours of trading, ultimately closing at 1284.50, down another $50 from the previous day. Wednesday was uneventful but painful, opening at 1282.25 and closing at 1277.5 - total per-contract loss: $975, ouch. But then something interesting happened. Another buy signal came along, this one on Russell 2000 Futures, giving me a decision to make.

In a previous trade a few weeks ago, I found myself in a similar situation: S&P had continued to move down for a couple days after initiating a position, costing me losses and threatening my stop-loss; then Russell signaled. In that previous trade, I elected not to take the second entry signal, reasoning that in a real money account I probably wouldn't have or wouldn't care to risk additional margin on what I knew to be a highly correlated market. That time, I watched as the Russell rocketed up the next day - I think I ended up scratching the S&P position, and missed a $1500 winner in the Russell. After thinking about it some, I realized that a secondary entry like that is an even stronger signal. CiG is a mean-reversion trade, entering a buy order when the market has sold down too much. When it moves down even further, even more correctional pressure builds up, indicating a higher probability of the market returning to (or near) its previous range.

Or else it's the beginning of a downtrend, and your position is doomed - you never can tell which.

Since I try to learn from my trading mistakes (my many, many trading mistakes), this time I decided to take that secondary signal. I bought Russell Futures at the Wednesday close for 787. Thursday was the corrective rally I'd been looking for, with Russell reaching a high of 796.70, and S&P a high of 1294. When it was clear I was seeing my rally, I changed my stop-losses into trailing stops so that I wouldn't have to babysit the position (I do have work to do, after all). When the market started to sell off hard after 2:00pm, both of my trailing stops exited me from the trade at better prices than if I had waited for the close: 1289.50 for the S&P ($375/contract loss), and 794.10 for the Russell ($710/contract profit).

NeighborTrader pointed out that technically there was no exit signal in either product, and he's right. But it was clear to me that the corrective rally had come and gone - staying in the trade any longer was asking for trouble, in my opinion. Sure enough, Friday was another down day, with the S&P and Russell closing at 1269.75 and 779, respectively - representing a total stop-constrained loss of over $2000/contract.

I'll take a $365 profit while avoiding a $2000 loss any day, won't you?

In a previous trade a few weeks ago, I found myself in a similar situation: S&P had continued to move down for a couple days after initiating a position, costing me losses and threatening my stop-loss; then Russell signaled. In that previous trade, I elected not to take the second entry signal, reasoning that in a real money account I probably wouldn't have or wouldn't care to risk additional margin on what I knew to be a highly correlated market. That time, I watched as the Russell rocketed up the next day - I think I ended up scratching the S&P position, and missed a $1500 winner in the Russell. After thinking about it some, I realized that a secondary entry like that is an even stronger signal. CiG is a mean-reversion trade, entering a buy order when the market has sold down too much. When it moves down even further, even more correctional pressure builds up, indicating a higher probability of the market returning to (or near) its previous range.

Or else it's the beginning of a downtrend, and your position is doomed - you never can tell which.

Since I try to learn from my trading mistakes (my many, many trading mistakes), this time I decided to take that secondary signal. I bought Russell Futures at the Wednesday close for 787. Thursday was the corrective rally I'd been looking for, with Russell reaching a high of 796.70, and S&P a high of 1294. When it was clear I was seeing my rally, I changed my stop-losses into trailing stops so that I wouldn't have to babysit the position (I do have work to do, after all). When the market started to sell off hard after 2:00pm, both of my trailing stops exited me from the trade at better prices than if I had waited for the close: 1289.50 for the S&P ($375/contract loss), and 794.10 for the Russell ($710/contract profit).

NeighborTrader pointed out that technically there was no exit signal in either product, and he's right. But it was clear to me that the corrective rally had come and gone - staying in the trade any longer was asking for trouble, in my opinion. Sure enough, Friday was another down day, with the S&P and Russell closing at 1269.75 and 779, respectively - representing a total stop-constrained loss of over $2000/contract.

I'll take a $365 profit while avoiding a $2000 loss any day, won't you?

01 June 2011

Happy 1980

It's June, which means the year-a-month project has finally made it to 1980, the year I've been waiting for. This month we have a bunch of big changes:

Black Sabbath: Heaven and Hell - the first Black Sabbath album featuring the late great Ronnie James Dio, who came in to replace Ozzy, who was fired for heavy alcohol and drug abuse in April 1979. This album marked a powerful shift in Black Sabbath's sound, and contains the massive hit song by the same name as the album.

Ozzy Osbourne: Blizzard of Ozz - Ozzy's first solo album. I actually had some trouble with this one. The MP3 album at Amazon, it turns out, is the 2002 re-release in which the original drum and bass parts had been stripped out and replaced. Oooh, the customer reviews were not kind to Sharon Osbourne about that. Luckily for me, Sony re-re-released a "30th anniversary edition" on, I kid you not, May 27th, 2011. This version appears to be, if not exactly the original arrangement, at least a lot closer.

Judas Priest: British Steel - Scott Ian of Anthrax said that this album defined heavy metal, doing away with the "last shards of blues" and ushering in the great 1980s heavy metal sound. I'm not sure I'd go that far, but Judas Priest never fails to impress.

Last but not least, Iron Maiden's eponymous debut album was also published in 1980. As I mentioned last month, Iron Maiden is one of the reasons I started this project, so finally catching up to them is rewarding. And the album rocks.

Black Sabbath: Heaven and Hell - the first Black Sabbath album featuring the late great Ronnie James Dio, who came in to replace Ozzy, who was fired for heavy alcohol and drug abuse in April 1979. This album marked a powerful shift in Black Sabbath's sound, and contains the massive hit song by the same name as the album.

Ozzy Osbourne: Blizzard of Ozz - Ozzy's first solo album. I actually had some trouble with this one. The MP3 album at Amazon, it turns out, is the 2002 re-release in which the original drum and bass parts had been stripped out and replaced. Oooh, the customer reviews were not kind to Sharon Osbourne about that. Luckily for me, Sony re-re-released a "30th anniversary edition" on, I kid you not, May 27th, 2011. This version appears to be, if not exactly the original arrangement, at least a lot closer.

Judas Priest: British Steel - Scott Ian of Anthrax said that this album defined heavy metal, doing away with the "last shards of blues" and ushering in the great 1980s heavy metal sound. I'm not sure I'd go that far, but Judas Priest never fails to impress.

Last but not least, Iron Maiden's eponymous debut album was also published in 1980. As I mentioned last month, Iron Maiden is one of the reasons I started this project, so finally catching up to them is rewarding. And the album rocks.

Subscribe to:

Posts (Atom)